The global feed pellet mill industry has demonstrated remarkable resilience and growth, with the market valued at approximately $1.1 billion in 2024 and projected to reach $1.9 billion by 2033, representing a compound annual growth rate (CAGR) of 7.1%. This robust growth trajectory is driven by increasing global protein demand, expanding aquaculture operations, and technological advancements in pelletizing equipment. The industry is characterized by fragmented market structure with numerous regional and international players competing across different segments and geographic markets.

1. Market Overview and Size

Global Market Valuation

The feed pellet mill industry presents varying market size estimates from different research sources, indicating the diverse scope of market definitions:

- Feed Mill Market: Valued at $0.84 billion in 2024, projected to reach $1.14 billion by 2033 (CAGR: 3.5%)

- Feed Pellet Machine Market: $1.1 billion in 2024, expected to reach $1.9 billion by 2033 (CAGR: 7.1%)

- Feed Pellet Mills Market: $293 million in 2025, with robust growth at 5.2% CAGR through 2033

- Feed Pelleting Machine Market: $180 billion in 2024, projected to $265.94 billion by 2032 (CAGR: 5.0%)

Market Growth Drivers

Primary Growth Catalysts:

- Rising Global Population: Increasing demand for animal protein driving feed production requirements

- Aquaculture Expansion: Global aquaculture production reached 214 million tons in 2024 according to FAO

- Sustainable Feed Solutions: Growing emphasis on efficient feed conversion and nutritional optimization

- Technology Advancement: Integration of automation and digitalization in pellet production

- Livestock Industry Growth: Expansion of poultry, swine, and cattle farming operations globally

2. Industry Segmentation Analysis

By Application

- Animal Feed Production: 65% market share

- Aquaculture Feed: 20% market share (fastest growing segment)

- Pet Food Manufacturing: 10% market share

- Specialty Feed Applications: 5% market share

By Capacity

- Small Scale (Below 1 ton/hour): 30%

- Medium Scale (1–5 tons/hour): 45%

- Large Scale (Above 5 tons/hour): 25%

Geographic Distribution

- Asia-Pacific: 45% market share (largest regional market)

- North America: 25% market share

- Europe: 20% market share

- Latin America: 7% market share

- Middle East & Africa: 3% market share

3. RICHI Machinery Company Profile

Company Background

RICHI Machinery stands as a prominent player in the global pelletizing solutions market, with over 20 years of experience in the industry. The company has established itself as a comprehensive equipment manufacturer specializing in pellet machinery and complete turnkey solutions.

Core Business Areas

- Primary Focus: Pellet machinery manufacturing and pelletizing solutions

- Secondary Operations: Feed machinery, wood machinery, biomass equipment

- Service Portfolio: Turnkey projects from design to commissioning

Global Presence

RICHI Machinery has achieved significant international expansion, covering more than 140 countries and regions worldwide since 1995. The company’s products are exported to diverse markets including:

- Middle East

- South America

- Africa

- Southeast Asia

- Europe and United States (high-end markets)

Technology and Innovation

- R&D Investment: More than 3% of total annual sales dedicated to research and development

- Design Systems: CAD, SolidWorks computer-aided design platforms

- Analysis Software: ANSYS, MATLAB simulation analysis tools

- Development Tools: VCC, EasyBuilder8000 programming systems

- Innovation Approach: “Independent innovation” R&D philosophy

4. Competitive Landscape Analysis

Major Market Players and Global Market Share

Based on industry research, the competitive landscape includes several key manufacturers with their respective global market positions:

- Buhler Group (Switzerland) — 18%-22% global market share

- Andritz AG (Austria) — 15%-18% global market share

- RICHI Machinery (China) — 11%-15% global market share

- SKIOLD Group (Denmark) — 8%-12% global market share

- Anderson International (USA) — 6%-9% global market share

- Shanghai ZhengChang International Machinery — 5%-8% global market share

- Nukor Group — 3%-5% global market share

Note: Market share percentages are estimates based on industry analysis and may vary by region and application segment.

RICHI Machinery Competitive Positioning

Strengths

- Experience: Over 20 years in pelletizing solutions

- Global Reach: Operations in 140+ countries and regions

- Market Share: 11%-15% global market share

- Comprehensive Solutions: Complete turnkey project capabilities

- Technology Investment: Consistent 3%+ R&D investment

- Market Diversity: Serving multiple sectors (feed, biomass, wood pellets)

Competitive Advantages

- Turnkey Solutions: End-to-end project management from design to commissioning

- Geographic Coverage: Extensive international presence with local market knowledge

- Technology Integration: Advanced CAD and simulation software utilization

- Product Diversification: Multiple pellet applications beyond traditional feed

- Market Position: Solid 11%-15% global market share indicating strong competitive standing

Market Share Analysis

The global feed pellet mill industry demonstrates a moderately concentrated market structure:

Market Leadership Tier (15%+ market share):

- Buhler Group leads with 18%-22% market share, leveraging Swiss engineering excellence

- Andritz AG holds 15%-18% market share through industrial process technology leadership

Strong Competitive Tier (10%-15% market share):

- RICHI Machinery maintains 11%-15% market share with strong emerging market presence

- SKIOLD Group captures 8%-12% market share focusing on agricultural feed processing

Emerging Players (Below 10% market share):

- Multiple regional and specialized manufacturers compete for remaining market share

- Fragmented nature provides opportunities for growth and consolidation

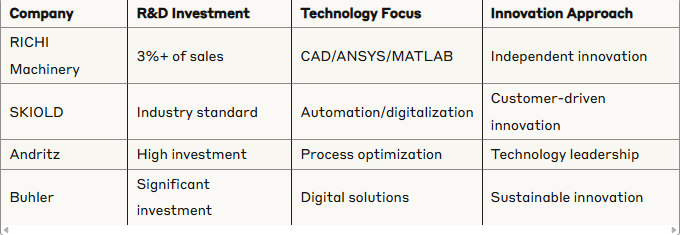

5. Competitive Comparison Matrix

Technology and Innovation Comparison

| Company | R&D Investment | Technology FocusInnovation | Approach |

| RICHI Machinery | 3%+ of sales | CAD/ANSYS/MATLAB | Independent innovation |

| SKIOLD | Industry standard | Automation/digitalization | Customer-driven innovation |

| Andritz | High investment | Process optimization | Technology leadership |

| Buhler | Significant investment | Digital solutions | Sustainable innovation |

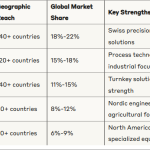

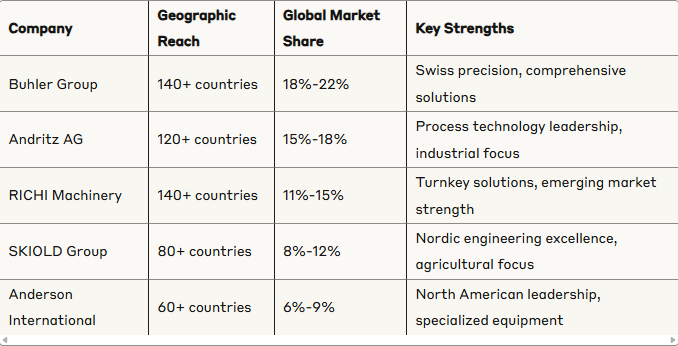

Market Presence Comparison

| Company | Geographic Reach | Global Market Share | Key Strengths |

| Buhler Group | 140+ countries | 18%-22% | Swiss precision, comprehensive solutions |

| Andritz AG | 120+ countries | 15%-18% | Process technology leadership, industrial focus |

| RICHI Machinery | 140+ countries | 11%-15% | Turnkey solutions, emerging market strength |

| SKIOLD Group | 80+ countries | 8%-12% | Nordic engineering excellence, agricultural focus |

| Anderson International | 60+ countries | 6%-9% | North American leadership, specialized equipment |

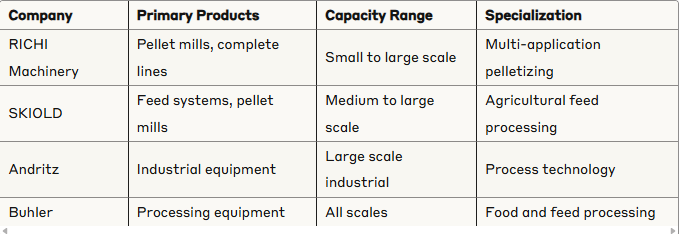

Product Portfolio Comparison

| Company | Primary Products | Capacity Range | Specialization |

| RICHI Machinery | Pellet mills, complete lines | Small to large scale | Multi-application pelletizing |

| SKIOLD | Feed systems, pellet mills | Medium to large scale | Agricultural feed processing |

| Andritz | Industrial equipment | Large scale industrial | Process technology |

| Buhler | Processing equipment | All scales | Food and feed processing |

6. Market Trends and Future Outlook

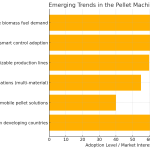

Emerging Trends

Technology Integration

- Artificial Intelligence and IoT implementation in pellet production

- Predictive maintenance and real-time monitoring systems

- Energy-efficient pelletizing technologies

Sustainability Focus

- Increased demand for eco-friendly pelletizing solutions

- Alternative raw material utilization (agricultural waste, byproducts)

- Carbon footprint reduction initiatives

Market Expansion

- Growing aquaculture industry driving specialized feed pellet demand

- Pet food industry premiumization creating new opportunities

- Developing markets in Asia-Pacific and Africa showing rapid growth

Future Projections (2025–2033)

Market Size Growth

- Overall market expected to grow at 5–7% CAGR

- Aquaculture segment projected to lead growth rates

- Technology-advanced equipment commanding premium pricing

Regional Development

- Asia-Pacific to maintain largest market share

- African and Latin American markets showing accelerated adoption

- Developed markets focusing on efficiency and automation upgrades

Technology Evolution

- Increased automation and digitalization adoption

- Energy efficiency becoming primary selection criteria

- Customization and modular solutions gaining preference

7. RICHI Machinery Strategic Position and Recommendations

Current Market Position

RICHI Machinery demonstrates strong competitive positioning through:

- Established global presence across diverse markets

- Comprehensive turnkey solution capabilities

- Consistent technology investment and innovation

- Multi-sector application expertise

Strategic Recommendations

Short-term Strategies (1–2 years)

- Technology Enhancement: Increase R&D investment to 4–5% of sales to accelerate innovation

- Digital Integration: Implement IoT and AI capabilities in product offerings

- Market Penetration: Strengthen presence in high-growth aquaculture segment

- Service Expansion: Develop comprehensive after-sales and maintenance services

Medium-term Strategies (3–5 years)

- Strategic Partnerships: Form alliances with technology leaders for advanced automation

- Capacity Expansion: Increase manufacturing capacity to meet growing demand

- Geographic Focus: Intensify operations in high-growth regions (Africa, Southeast Asia)

- Product Innovation: Develop specialized solutions for emerging applications

Long-term Strategies (5+ years)

- Market Leadership: Establish position among top 3 global players

- Technology Integration: Become leader in smart pelletizing solutions

- Sustainability: Pioneer eco-friendly and energy-efficient technologies

- Vertical Integration: Consider strategic acquisitions to expand capabilities

8. Risk Analysis and Mitigation

Market Risks

- Economic Volatility: Global economic downturns affecting capital equipment investments

- Raw Material Price Fluctuations: Impact on customer investment decisions

- Regulatory Changes: Environmental and safety regulations affecting operations

Competitive Risks

- Technology Disruption: Rapid advancement by competitors

- Price Competition: Pressure from low-cost manufacturers

- Customer Concentration: Over-reliance on specific geographic markets

Mitigation Strategies

- Diversification: Maintain broad geographic and application portfolio

- Innovation Investment: Continuous technology development to stay competitive

- Financial Flexibility: Maintain strong balance sheet for market fluctuations

- Customer Relationships: Develop long-term partnerships and service agreements

9. Conclusion

The feed pellet mill industry presents significant growth opportunities, with market valuations projected to nearly double over the next decade. RICHI Machinery is well-positioned to capitalize on these opportunities through its established global presence, comprehensive solution capabilities, and commitment to innovation.

The company’s competitive advantages in turnkey solutions, geographic reach, and technology investment provide a strong foundation for continued growth. However, success will require strategic focus on emerging technologies, sustainability solutions, and market-specific customization to maintain competitive differentiation.

Key success factors for RICHI Machinery include:

- Accelerated technology innovation and digital integration

- Strengthened presence in high-growth segments like aquaculture

- Enhanced service capabilities and customer relationships

- Strategic partnerships for advanced technology access

The global feed pellet mill industry’s positive outlook, combined with RICHI Machinery’s strategic positioning, suggests strong potential for continued growth and market share expansion in the coming years.

Report Prepared: September 2025

Data Sources: Industry research reports, company information, market analysis

Forecast Period: 2025–2033